Animal husbandry is an important part of agricultural development. And the insurance of breeding industry, as a major branch of agricultural insurance, is an important part of the agricultural financial service system and an important part of the country's rural revitalization.

It is difficult to verify the number of targets

Difficulty in handling insurance claims

Difficulty in judging insurance liability

Post-insurance supervision platform structure

after insurance

AIOT smart farm

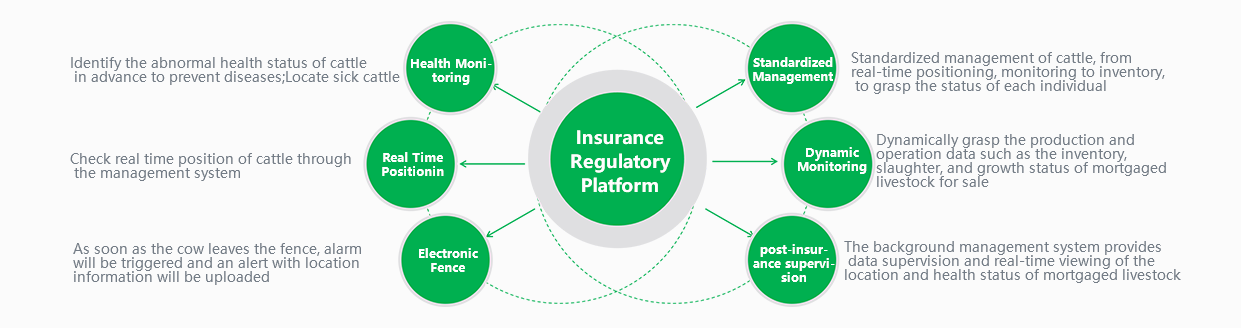

Insurance Regulatory Platform

Post-insurance supervision platform Solution

after insurance

Standardized management of cattle, from real-time positioning, monitoring to inventory, to grasp the status of each individual

Identify the abnormal health status of cattle in advance to prevent diseases;Locate sick cattle

Check real time position of cattle through the management system

Dynamically grasp the production and operation data such as the inventory, slaughter, and growth status of mortgaged livestock for sale

As soon as the cow leaves the fence, alarm will be triggered and an alert with location information will be uploaded

The background management system provides data supervision and real-time viewing of the location and health status of mortgaged livestock

Post-insurance supervision platform

Regulatory platform

Intuitively understand the scale of loan object farms;

Real-time monitoring and early warning of the total loan amount, the number of targets and the risk index of the loan farm;

Perform asset appraisals on all mortgaged livestock assets on the farm;

Track specific files for each animal on the farm

Difficulties in the insurance of breeding industry

insurance